estate tax changes in 2025

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. You can gift up to the exemption amount during life or at death or some combination thereof tax-free.

How The Tcja Tax Law Affects Your Personal Finances

The estate tax exclusion has increased to 1206 million.

. Yahoo Finances recent article IRS Says Millionaires Can Keep Estate Tax Benefits After 2025 says that the exemption increase was a big priority for Republicans in the 2017 tax overhaul. Standard deduction starting in 2018 was 24000 for married persons filing jointly 18000. This report describes the basic structure of the estate and gift tax provides a brief history of.

The exemption was 55 million prior to the law change. The chart below shows the current tax rate and exemption levels for the gift and estate tax. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

The exemption amount gets adjusted each year and if no change in the law is made it will increase to approximately 12060000 in 2022. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. For 2018 the inflation-adjusted BEA is 1118 million.

Additionally there are four tax rates for estates and trusts. If a decedent dies in 2026 with an estate of 11700000 the exemption amount would. No Changes to the Current Gift and Estate Exemption Provisions Until 2025.

10 24 35 and 37. Specifically the Federal Estate Tax Exemption would not expire at the end of 2025. A window of opportunity opened in 2018 when the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax exemptions to 1118.

The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025. The credit is first used during life to offset gift tax and any remaining credit is available to reduce or eliminate estate tax. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022.

That is only four years away and Congress could still. Recent Changes in the Estate and Gift Tax Provisions Updated October 19 2021 Congressional Research Service httpscrsreportscongressgov. Under current law the estate and gift tax exemption is 117 million per person.

The current estate tax exemption is 12060000 and double that amount for married couples. The law also changed standard deduction. Under the tax reform law the increase is only temporary.

The Tax Cuts and Jobs Act of 2017 increased the federal gift and estate tax basic exclusion amount BEA to 1158 million per individual or 2316 million per couple adjusted for. For 2021 the exemption is 117 million. Under current law the existing 10 million exemption would revert back to the 5 million exemption.

Couples can pass on 228 million. After that the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

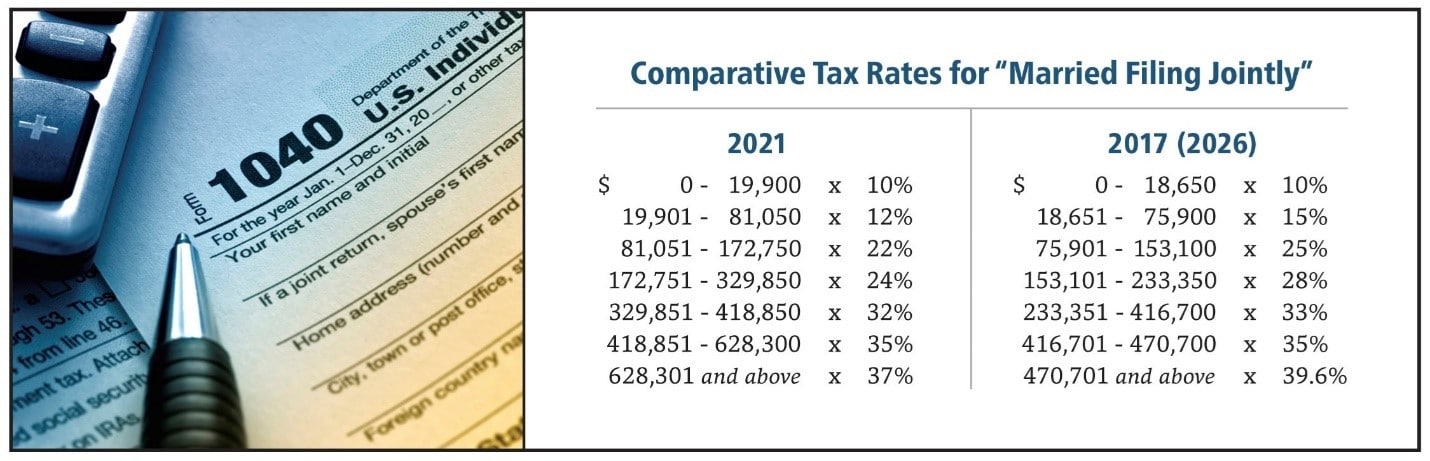

Currently there are seven different tax rates for individuals the lowest being 10 and the highest falling from 396 to 37. Individuals can transfer up to that amount without having to worry about federal estate taxes. With proper trust provisions a married couple could pass 2412 million.

There are pending bills which would decrease the estate tax exclusion even more. 115-97 effective from 2018 to 2025. Highest tax rate for gifts or estates over the exemption amount Gift and estate exemption 2017 and prior years Gift and estate exemption 2022 expires in 2025 40.

This exemption decreased the number of individuals whod. However Democrats are looking to reverse those changes if they sweep the House Senate and White House in the 2020 national elections. This is the amount one person can pass gift and estate tax free during their life or upon death.

The higher levels expire in 2026 but individuals who make large gifts while the exemption is higher and die after it. This Federal Estate Tax Exemption under the 2017 Trump Tax Cuts would be set to expire at the end of 2025. Yahoo Finances recent article IRS Says Millionaires Can Keep Estate Tax Benefits After 2025.

These changes were instituted by the IRS pursuant to the federal law enacted in 2017However the estate tax law is set to expire in 2025If Congress does not extend the estate tax law the amount of the estate tax exclusion could revert back to under 6 million. Anticipating Law Changes in 2022. Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million and for 2020 the BEA is 1158 million.

This piece of mind however severely decreases after December 31 2025. The tax reform law doubled the BEA for tax-years 2018 through 2025. How did the tax reform law change gift and estate taxes.

Estate Tax Exclusion Changes Now and in 2025. 2 In addition the 40 maximum gift and estate tax rate is set to increase to 45 in 2026. The bill introduced by the House Ways Means Committee is attempting to change this and roll back the 2017 Trump Tax Cuts.

When the calendar turns to 2026 the estate tax provisions implemented by the Tax Cuts. With the passage of the Tax Cuts and Jobs Act. October 14 2020.

What could change. With inflation this may land somewhere around 6 million. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to.

The annual amount that can be gifted each year without reporting is now. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. The TCJA temporarily increased the BEA from 5 million to 10 million for tax years 2018 through 2025 with both dollar amounts adjusted for inflation.

Starting January 1 2026 the exemption will return to 549 million adjusted for inflation. The exemption will increase with inflation to approximately 12060000 per person in 2022.

How Could We Reform The Estate Tax Tax Policy Center

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

2020 Estate Planning Update Helsell Fetterman

Estate Taxes Under Biden Administration May See Changes

U S Estate Tax For Canadians Manulife Investment Management

Estate Taxes Under Biden Administration May See Changes

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Where Not To Die In 2022 The Greediest Death Tax States

What Happened To The Expected Year End Estate Tax Changes

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Historical Estate Tax Exemption Amounts And Tax Rates 2022

U S Estate Tax For Canadians Manulife Investment Management

Start Planning Now For A Higher Tax Environment Pay Taxes Later

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)